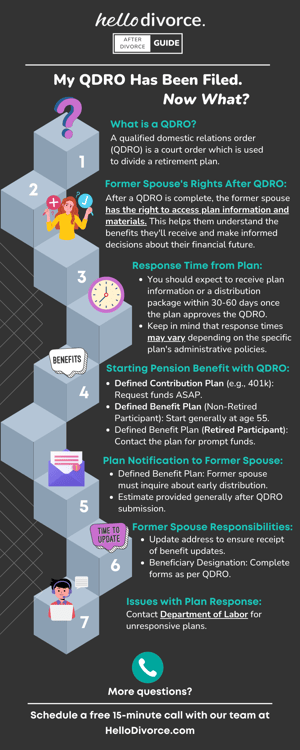

My QDRO Has Been Filed. Now What?

- Former spouse rights after QDRO

- When can I receive funds?

- Will the plan contact me?

- Former spouse responsibilities

- Other important information

There's a lot to think about after divorce. This includes your Qualified Domestic Relations Order (QDRO), which will divide your retirement plans.

You may have questions after your QDRO is filed and sent to your retirement plan. What are both parties' rights, responsibilities, and next steps? What should the participant (member or employee) and the former spouse (non-member, alternate payee, payee) expect and do?

Here are the answers to frequently asked questions about QDROs.

Once the QDRO is completed, what rights does the former spouse have?

A former spouse has the right to receive plan information and materials. This will help them understand the benefits they will receive. In turn, this helps them make informed decisions on how to receive benefits.

How long will it take to hear from the plan after it receives the QDRO?

Plan information or a distribution package should be received within 30 to 60 days of the plan's final approval of the QDRO. Since each plan has different administrative policies, however, there is no perfect answer to this question.

When is the earliest time a former spouse can start a pension benefit with a QDRO?

If the QDRO divides a defined contribution plan (e.g., 401k), in almost all cases, the former spouse should arrange to receive funds as soon as administratively possible. If the QDRO divides a defined benefit plan and the participant is NOT yet retired, the former spouse may choose to start the pension generally once the participant is at least 55.

In most cases, the former spouse may elect to receive benefits once the participant reaches the earliest retirement age (which is almost always age 55) through the date the participant starts the pension. If the QDRO divides a defined benefit plan and the participant is retired, the former spouse should contact the plan and arrange to receive funds as soon as administratively possible.

If the participant is not retired, will the plan contact the former spouse to tell them they are eligible to start the pension?

If the QDRO divides a defined benefit plan, which may pay early retirement benefits once the participant reaches a certain age (generally age 55), the plan will not notify the former spouse that they are eligible to start receiving benefits. Therefore, it is the former spouse's responsibility to learn when the plan will permit an early distribution. The former spouse will need to request an estimate of the monthly benefit and notify the plan when they want payments to begin.

Will a plan give the former spouse an estimate of the value of the participant's retirement benefit?

Generally, once the QDRO is sent to the plan, the plan will provide the former spouse an estimate of their share of the retirement benefit.

Once the QDRO is sent to the plan, what other responsibilities does a former spouse have?

It is always the former spouse's responsibility to notify the plan of any change of address. This way, they continue to receive updated information and materials concerning benefits.

Also, if the QDRO permits the former spouse to designate a beneficiary, they must contact the plan immediately once the QDRO is sent to the plan to complete the proper beneficiary designation forms.

What happens if the plan does not respond to the QDRO or does not provide information regarding the former spouse's rights to retirement benefits?

Should any issues arise with the plan failing to respond to the QDRO or failing to provide information concerning the former spouse's rights to benefits, one remedy is to contact the Department of Labor. There are multiple offices throughout the U.S. Every Department of Labor office has a department that handles pension division issues.

What happens if a divorced participant does not update beneficiary forms?

After divorce, the participant of a retirement benefit should review their beneficiary designation and make any necessary changes by completing a new beneficiary designation form. A U.S. Supreme Court decision held that even if the divorce judgment revokes the beneficiary designation of the former spouse unless the participant changes that beneficiary form with the plan, the plan will be required to distribute benefits to the former spouse. (Kennedy v. Plan Adm'r for DuPont Sav. & Inv. Plan, 555 U.S. 285, 129 S. Ct. 865, 172 L. Ed. 2d 662 (2009).

The goal of this post is to break down the most important pieces to understand once a QDRO has been filed and sent to the plan. If you have additional questions about the process or want to speak with a QDRO Counsel expert, please don't hesitate to reach out via our website. (Mention Hello Divorce to get your free 15-minute call!)

Are you ready to file a QDRO? Secure your retirement post-divorce at a transparent, flat-rate fee. Click to learn more.

.png)

Filing a QDRO is just one task.

Make sure you've got everything covered with our FREE checklist.

Suggested: QDRO Glossary

The Center’s mission is to close the justice gap by providing access to high-quality QDRO products to nonprofit legal services organizations, self-help centers & qualified individuals in financial distress. The Center is supported by grants, nonprofit legal organizations and court-based self-help centers. Also as a way to give back to the community, QDROCounsel has provided the Center with financial support by donating an exclusive license to use QDROCounsel’s technology and by providing the resources to support that technology.