Calculating a House Buyout in Divorce

- What is a house buyout?

- Glossary of house buyout terms

- What options are available for your house

- How buyouts of a home get calculated

- How to buy out a house

- Buying out the house when children are involved

- Is a home buyout taxable?

- FAQ

- How to Calculate a House Buyout in Divorce (Step by Step)

- References

Are you and your ex deciding how to split your home equity? You can use an online calculator to find out how much it would cost to buy out your ex. But what exactly does a buyout entail, and what factors influence the final amount?

What is a house buyout?

A house buyout is a process in which one party purchases the other party's share or ownership interest in a shared property, typically during a divorce, separation, or partnership dissolution. This allows the buyer to assume full ownership of the property while compensating the other party for their portion of its value.

Are you and your ex deciding how to split your home equity?

You and your spouse have decided to divorce, and you’ve hit the first roadblock. Will one of you retain the house, or will you sell it? How will you split the value fairly between you? And, if one of you decides to keep the house, how does the other get paid for their share?

Bottom line: You have several options. One option you might consider is a house buyout. So, what is a house buyout, and how could it work in your situation? Let’s take a look.

Who Gets The House In Divorce? How Do I Split The Value? Do I Need To Sell?

Glossary of important terms

Before we go any further, it can be helpful to understand the terms used in real estate interactions in divorce. Here’s a helpful glossary.

Buyout: A buyout is when one spouse pays the other their fair share of the home’s value or equity.

Equity: Equity is the market value of a home minus any mortgages or other encumbrances.

Mortgage obligation: A homeowner’s mortgage obligation is the terms to which they’ve agreed to repay their mortgage financing.

Appraised value: The appraised value of a home is a professional appraiser’s determination of its market value using many different factors.

Sale-leaseback: A sale-leaseback is when a homeowner sells their home and then continues to live there, paying the new owner monthly rent under a lease agreement.

Home equity investment: A home equity investment, or home equity sharing agreement, is when a third party (investor) agrees to give a homeowner an amount of money for a share of their home’s future equity at a specified time.

Cash-out refinance: A cash-out refinance is when a homeowner refinances the home at its current value, pays off the balance of the old mortgage, and keeps the difference as cash.

Personal loan: A personal loan is generally an unsecured loan offered by a bank or other lending institution for any purpose. Because it is unsecured, a personal loan is a bigger risk for the lender and will typically be shorter-term than a mortgage and at a higher interest rate.

HELOC: A HELOC, or home equity line of credit, is a type of secured financing using the home as collateral. It allows a homeowner to borrow against their home’s equity with a revolving credit line, similar to a credit card. As payments are made, the limit a homeowner may borrow at any one time can increase.

Home equity loan: A home equity loan is another type of secured financing using the home as collateral. It allows a homeowner access to their home’s equity in one lump sum and is paid back in monthly payments.

Reverse mortgage: A reverse mortgage is another type of secured financing using the home as collateral. It allows a homeowner access to their home’s equity, but no monthly payments are made. Instead, interest and fees are accrued and added to the mortgage’s balance over time. The balance becomes due when the homeowner leaves the home.

Free Download: Divorce & Your Home — 2026 Guide

Equity calculation, buyout options, keeping vs. selling, and how to protect your financial future.

What options are available for your house when going through divorce?

When divorcing, there are several paths you could take when it comes to your house. The primary paths are selling the property, one spouse buying out the other, and co-owning the property.

Sell the property

One of the easiest options for dealing with your home when you’re going through a divorce is to just sell the property and divide the proceeds from the sale with your ex.

In a situation like this, you and your ex would each get a portion of the profits, and each would have to find a new place to live. This is a good option if you have no children from the marriage or your children are adults whose lives will not be too significantly disrupted by the divorce. It's also an easy solution if you both equally contributed to the purchase of the home.

If, on the other hand, you are still making payments on the house, selling it would add to the balance that you and your ex must address. Selling the house while still making payments is not for everyone. If one spouse has no income or cannot find other housing, for example, the other spouse would have to pay off a greater degree of the debt than may be considered fair.

Tax benefits

There are tax benefits to selling the home. To file a tax return jointly, a couple must still be married on December 31 of the year for which they are filing their taxes, excluding up to $500,000 of their profit from selling the house. If they were to file individually, their exclusion limit would be just $250,000. If the profits from the sale of the house are more than $500,000, the spouses could split the tax bill equally.

While there are benefits to selling your home, you should know that you and your spouse would also have to share in the selling cost. This expense could reduce how much you walk away with in the divorce.

Buy out your spouse

A second option is for one spouse to buy out the other's share of the home.

Step-by-step process for a home buyout

- You and your spouse decide that one of you would like to keep the home to live in. You have considered the alternatives and want to research how a buyout might work for you.

- You contact a professional home appraiser to determine the current market value of the home. You might get a referral from a local real estate professional or the name of a local appraiser through the National Society of Appraisers.

- You and your spouse calculate the equity in your home. This is the market value of your home at that time minus any liabilities, including your mortgage balance and any outstanding interest.

- You and your spouse agree to a fair division of that equity. Remember that “fair division” can differ depending on whether you live in a community property state or an equitable distribution state. If you and your spouse can cooperate, you can agree to what you consider fair or find other ways to make it more equitable, such as trading other shared assets to make up for any inequities.

- If you have an outstanding mortgage on your home, you can’t just remove one person from the mortgage obligation and change ownership of the home. Before one of you can take sole ownership of the house, the current mortgage must be paid off so ownership can be changed.

- The spouse who wants to retain ownership of the home will apply for financing based on their own credit score, income, and debts. This is when you will need to consider the financial implications of how to do this. Will the spouse keeping the home be able to get approved for financing on their own? Will they be able to afford to pay mortgage payments and the costs of homeownership by themselves? If approved for this new financing, it would pay off the old mortgage and fund the other spouse their share of the equity.

- Finalize the buyout. If the buyout is a cash transaction, the buying spouse pays the other the agreed-upon buyout figure. The spouse relinquishing ownership of the home would then deed their share of the property to the spouse maintaining ownership. If financing is involved, the spouse keeping the home would close on the new loan, and the other spouse would be paid their share of the equity from the proceeds of the new financing. At this point, ownership is generally transferred to the other spouse via a quitclaim deed.

Example of a home buyout

Let's say you have $100,000 of equity in the house. The spouse who continues to live there could give up their share of other joint assets, assume a greater share of the marital debt, or secure a cash-out refinance loan to "buy out" the other. This would give the departing spouse their rightful share of the equity.

There are benefits to buyouts like this. For example, a buyout can be good for families with young kids since, by keeping the home, a sense of familiarity is preserved for the children.

One spouse keeping the house also means selling costs are kept low. However, this arrangement would not work if the spouse who stayed in the home did not have enough income or a high enough credit score to get approved for cash-out refinancing.

Another potential issue: If the cash-out refinancing increased the total loan balance, it could create financial hardship for the spouse staying in the home. And, if that spouse eventually decided to sell the house, the selling costs would be passed on to them directly. They wouldn’t share the selling costs with their former spouse because their former spouse would no longer be in the picture.

How to calculate the cost of a house buyout

To calculate the cost of a house buyout, follow these steps:

- Determine the property’s market value: Get an accurate estimate of your home’s current market value through an appraisal or comparative market analysis (CMA).

- Subtract your existing mortgage balance.

- Calculate the buyout share: If there are two owners, divide the equity by their respective shares (e.g., 50/50, 60/40) to determine how much one party owes the other.

- Consider additional costs such as closing costs, fees, and any necessary repairs or improvements to the property that may impact the buyout cost.

The final buyout amount is typically the other party’s share of the home’s equity plus any agreed-upon additional costs.

Co-own the house

Another option is to co-own the house after the divorce. If the divorce is friendly, this may be feasible. This is known as a deferred sale of the home.

The route of a deferred sale is sometimes taken when spouses decide to wait for their youngest child to graduate from high school before selling the house.

A deferred sale is also an option if the current housing market is not good for selling.

Co-owning the house may seem like the easiest option when you have so many other big life changes on your plate. However, it requires both divorcing spouses to be on the same page regarding mortgage payments, repairs and maintenance, insurance, property taxes, and other related costs.

Another benefit of deferring the sale of the house is that the costs and appreciation of the house are shared by both spouses. This might put both parties in a good position to sell the house when the time is right.

However, co-ownership means that each spouse would get no more than $250,000 of gains exempted from their income, which could affect one spouse disproportionately.

Need help understanding your home-related options?

Download Divorce & Your Home, our free three-step home solution with tips and worksheets to help you understand and make the most of your home's equity.

How does a home buyout get calculated in a divorce?

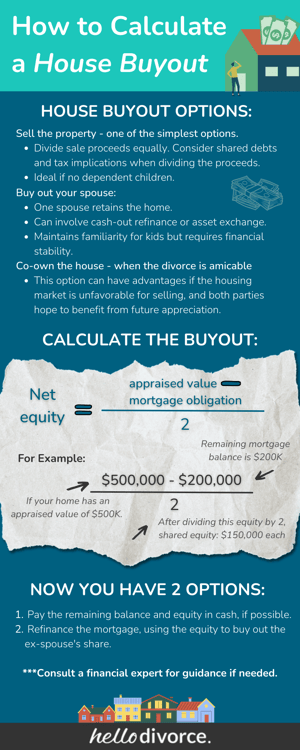

To calculate how much it would cost to buy your ex out of your shared home, you need to know the amount of equity you and your ex share in the home. Use this formula:

Net equity = (the appraised value - mortgage obligation) divided by 2.

- First, you must determine the appraised value.

- Once you have that figure, subtract the mortgage obligation from it. This is your total equity.

- Now it's time to calculate your net equity. Divide your total equity in half. This amount is each spouse's net equity.

Note: Even if your furniture is not being split equally, you can factor the value of that difference in at the end of the process.

Example: Let's say you and your ex own a home appraised at $500,000. You have a mortgage for $200,000 on the house, meaning you have $300,000 in shared equity. Divide that number in half, and you will see that each of you has $150,000 in equity.

To calculate the amount of the buyout, the formula is this:

- Equity divided by 2 plus any debt (since you would be assuming the debt by yourself)

Continuing the example, you would need to pay your ex $150,000 while assuming the $200,000 mortgage. If you were refinancing, you would need a new loan of $350,000.

But this simple scenario assumes that you live in a community property state and are dividing marital assets 50/50. If you live in an equitable distribution state, the division of your equity might be more complex.

Equitable distribution states consider many factors when determining fair property division. These include the length of the marriage, each spouse’s income, the contributions each has made to the marriage, and many other factors. These more nuanced factors would need to be considered when dividing the equity in your home for buyout purposes in an equitable distribution state.

You can use the Hello Divorce Home Equity Buyout Calculator to determine the split of the equity between you and your spouse.

How to buy out a house during a divorce

To buy out your house during a divorce, you have two options:

- Pay the remaining balance and the equity in cash

- Refinance your mortgage, and use the equity to buy out your ex

Financing options for buyouts

Common financing options include:

Cash-out refinance

How it works: The buyer refinances the existing mortgage for more than the amount owed, taking the difference in cash to pay the buyout.

Pros: Low interest rates (compared to other options) and the ability to borrow large amounts.

Cons: Closing costs, extending the mortgage term, and meeting credit and income requirements.

Home equity loan

How it works: A second loan is taken out using the equity in the home as collateral, providing a lump sum for the buyout.

Pros: Fixed interest rates, predictable payments, and access to a large sum if there is sufficient equity.

Cons: Risks to the property if payments aren’t made, and potentially high fees depending on the lender.

Home Equity Line of Credit (HELOC)

How it works: A revolving line of credit is secured by the home’s equity, and the buyer can draw funds as needed for the buyout.

Pros: Flexible borrowing and repayment, with access to funds as required.

Cons: Variable interest rates, and potential for high debt if borrowing exceeds the buyer's ability to repay.

Personal loan

How it works: An unsecured loan from a bank or lender is used to fund the buyout.

Pros: No collateral required and fast approval process.

Cons: Higher interest rates than secured loans and lower borrowing limits, which may not cover the full buyout amount.

Seller financing (if applicable)

How it works: The seller (the person selling their share of the property) acts as the lender, and the buyer agrees to make regular payments over time.

Pros: Flexible terms, often with lower interest rates.

Cons: Not commonly available and requires the seller to be willing to finance the transaction.

Bridge loan

How it works: A short-term loan that bridges the gap between the buyout cost and the buyer's ability to secure permanent financing.

Pros: Quick funding for immediate needs.

Cons: High interest rates and short repayment terms.

Each option has its advantages and trade-offs, and the best choice depends on the buyer’s financial position, the amount of equity in the home, and how long they plan to hold the property.

Buying out the house when children are involved

If children are involved, buying out the house during the divorce can be more complicated. Courts usually allow the custodial parent to stay at the house without having to buy out the other spouse. The other spouse might pay for some of the maintenance of the house as a form of child support and spousal support.

If you are not a custodial parent, you might have to wait for months or even years to buy out the house or sell it. The court would give your ex and the kids time to find a new place to live before anything happened to the house.

---Trying to figure out what's best for your kids and your finances at the same time? Our divorce coaches help you think through the emotional and practical sides of the home decision together. [Book a coaching session →]

Is a home buyout taxable?

Once the buyout is complete, the sale is considered part of the divorce. Thus, the spouse who sold their share of the house would not be affected by capital gains tax.

However, if you bought out your ex, stayed in the house for some time, and then later sold the house to a third party, that sale would be subject to capital gains tax.

Note: If you’ve lived in the house for more than two years from the time of the divorce to the sale, or if you qualify for one of the IRS exceptions to the rule, you have the right to exclude the first $250,000 of gains from the tax.

Tax implications of a home buyout can be surprisingly significant. A Certified Divorce Financial Analyst can run the numbers for your specific situation before you agree to anything.

[Book a CDFA session →]

FAQ about house buyouts

---Book a session with a Divorce Real Estate expert to get all the questions below answered for your specific situation[Book a Divorce Real Estate Expert session →]

How do you calculate a house buyout in a divorce?

Start with fair market value, subtract mortgage/HELOC payoffs and any liens to get equity. Adjust for agreed credits (separate down payment, capital improvements, repairs), then apply the agreed split to determine the buyout amount owed to the departing spouse.

What’s the formula for a buyout?

Buyout owed = (Adjusted Equity × Spouse’s agreed share) − Offsets already paid.

Adjusted Equity = Fair Market Value − (Payoffs + Liens) ± Credits/Debits (e.g., separate contributions, improvements, or repair allowances).

Do we need an appraisal, or is a CMA enough?

If you’re aligned on value, a CMA can be sufficient. If there’s disagreement or a formal buyout, a licensed appraisal provides a documented number that’s easier to include in your settlement.

Do we subtract selling costs if one spouse keeps the house?

Usually no—because no sale is occurring. Some couples agree to treat the buyout “as if sold,” but that’s optional and should be clearly stated in your settlement.

How are premarital down payments or separate funds handled?

If you can trace separate contributions, you can credit them before splitting the remainder (subject to your state’s rules). Keep documents like bank statements, closing disclosures, or gift letters.

Can repairs or deferred maintenance change the buyout?

Yes. You can agree to credits for necessary repairs or for improvements that increased value. Receipts or an appraiser’s adjustment help support the numbers.

What if we can’t refinance right away?

Set a refinance-by date with a fallback to list the home for sale. Include interim protections: who pays the mortgage, insurance, taxes, and what happens if deadlines aren’t met.

What is the legal process of transferring equity and removing someone from the title deeds?

The legal process typically involves the following steps:

- Both parties agree on the buyout price, and the buyer arranges financing to cover the other party’s share of the property.

- A deed of transfer is drafted, outlining the transfer of ownership and the removal of the other party from the title deeds.

- Both parties sign the deed of transfer in the presence of a notary (if required).

- The signed deed is submitted to the local land registry or county recorder’s office to update the title deed and officially transfer ownership.

- Pay any applicable taxes or fees associated with the transfer of property ownership.

Once completed, the title is updated to reflect the new owner, and the removed party no longer holds an interest in the property.

What happens if the spouse trying to buy out the home can’t secure new financing?

Unfortunately, that is a common problem. Getting financing on your own requires you to be approved for a new loan using your income, financial resources, and credit history. If you can’t secure the financing to buy your spouse out and pay off the existing mortgage, you will probably have to consider selling unless you can negotiate another option with your spouse.

What happens if one spouse doesn’t agree with the appraisal of the home and thinks it should be more?

If your spouse doesn’t feel the appraisal on the home is fair, you could each agree to hire your appraiser and split any difference, but keep in mind that each appraisal will cost money that chips away at the equity, which is at the heart of the matter.

What happens if one spouse can’t buy the other out, but wants to maintain the home to provide a sense of stability for their kids?

One option for co-parents who want to maintain as much normalcy as possible for their kids is to agree to a temporarily delayed sale. This way, the primary custodial parent can stay in the home while raising the children. In the meantime, the home is still jointly owned by both parties until a sale occurs at a designated time in the future. Both parties then get the benefit of any additional equity in the home once it is sold.

How to Calculate a House Buyout in Divorce (Step by Step)

1. Confirm fair market value.

Use a CMA if you agree on value; order a licensed appraisal for a formal number or if there’s disagreement.2. List debts and liens.

Gather payoff statements for mortgages/HELOCs, property taxes due, HOA, and any recorded liens or judgments.

3. Compute equity.

Equity = Fair Market Value − (All Payoffs + Liens). If the home isn’t being sold now, you typically do not subtract selling costs.

4. Apply adjustments.

Add credits for traceable separate contributions (e.g., premarital down payment) and agreed capital improvements; subtract repair allowances or deferred maintenance if applicable.

5. Calculate the buyout.

Buyout owed to the departing spouse = Adjusted Equity × that spouse’s agreed share (often 50% of marital/community equity) − any offsets already paid.

6. Choose funding and timing.

Decide among cash-out refinance, home equity, installments, or offset with other assets (like retirement via QDRO). Set a refinance-by date or payment schedule.

7. Document and safeguard.

Spell out the valuation, equity split, credits, payment method, deed transfer, mortgage removal, deadlines, and a fallback plan (e.g., list for sale) if refinance or payments don’t occur on time.

References

How to Sell or Retain a Home During a Divorce. HG.org.

Real Estate and Divorce. Michigan Legal Help.

Who Gets the Real Estate in a Divorce? (December 2022). Realty Biz News.

Divorce and Your Mortgage: Here’s What to Know. (June 2022). Bankrate.

Home Equity Loan Calculator. (March 2023). Forbes.

Follow These Steps to Keep the House After Divorce. (July 2019). Forbes.

Tax Considerations When Dividing Property in Divorce. (March 2013). Journal of Accountancy.

Broken Home: Divorce and the Principal Residence. (August 2009). Journal of Accountancy.