My QDRO Has Been Filed. Now What?

- What to do immediately after filing a QDRO

- Former spouse rights after QDRO

- How long will it take to hear back?

- What if the plan does not respond to the QDRO?

- Earliest a former spouse can start a pension benefit

- Will the plan contact me?

- Will a plan give the former spouse an estimate?

- Former spouse responsibilities (beneficiaries, etc.)

- Other important information

There's a lot to think about after divorce. This includes your Qualified Domestic Relations Order (QDRO), which will divide your retirement plans.

You may have questions after your QDRO is filed and sent to your retirement plan. What are both parties' rights, responsibilities, and next steps? What should the participant (member or employee) and the former spouse (non-member, alternate payee, payee) expect and do?

Here are the answers to frequently asked questions about QDROs.

What actions should a former spouse take immediately after filing a QDRO?

- Obtain a filed copy from the court.

- Submit to plan administrator: This can involve either mailing a certified copy or electronically submitting the document. Follow up to confirm receipt.

- Verify plan requirements with the plan administrator to ensure full compliance.

- Communicate with your attorney (if you have one) to let them know you have done the above.

- Regularly check the status of the QDRO with the plan administrator.

- Once the plan administrator reviews and approves the QDRO, obtain written confirmation. This approval ensures that the retirement plan assets will be divided as specified in the QDRO.

- If applicable, work with the plan administrator to set up your account for the portion of the retirement assets being allocated to you.

- Keep records of all communications, confirmations, and approvals related to the QDRO. Update your financial records to reflect the changes.

- Consider consulting a financial advisor to understand the tax implications and to plan how to manage and invest your retirement funds effectively.

Taking these steps helps ensure a smooth and timely division of retirement assets as specified in the QDRO.

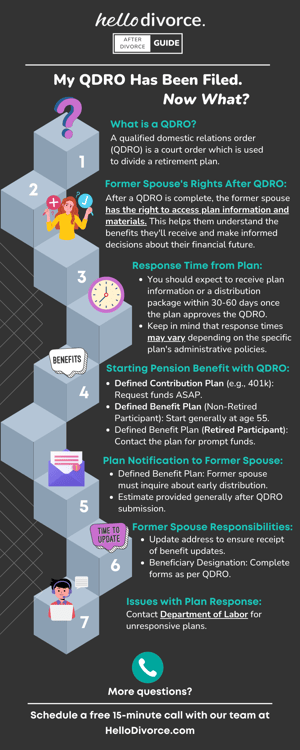

Once the QDRO is completed, what rights does the former spouse have?

A former spouse has the right to receive plan information and materials. This will help them understand the benefits they will receive. In turn, this helps them make informed decisions on how to receive benefits.

How long will it take to hear from the plan after it receives the QDRO?

Plan information or a distribution package should be received within 30 to 60 days of the plan's final approval of the QDRO. Since each plan has different administrative policies, however, there is no perfect answer to this question.

What if the plan does not respond to the QDRO?

If a retirement plan administrator does not respond to a QDRO or there are issues with the distribution of benefits, follow these steps:

1. Follow up with the plan administrator

- Initial contact: If there is no response after a reasonable period, follow up with the plan administrator via phone or email.

- Written request: Send a formal written request for a status update on the QDRO processing. Include details such as the date of submission, participant information, and any previous communication.

- Keep copies of all correspondence and notes from phone conversations.

2. Request an explanation

- Ask the plan administrator to explain any delays or issues with the QDRO processing.

- Request clarification if the QDRO was rejected, including the specific reasons and any necessary corrections or extra documentation required.

3. Involve legal help if necessary

4. Contact the plan sponsor (usually the employer) if the plan administrator is unresponsive (usually the employer) to escalate the issue.

5. File a complaint with the Department of Labor (DOL):

- Formal complaint: If the plan administrator continues to be unresponsive or there are ongoing issues, file a complaint with the DOL.

- Provide detailed information about the QDRO, your communications with the plan administrator, and any relevant documentation.

Department of Labor contact information

- Website: U.S. Department of Labor - Employee Benefits Security Administration (EBSA)

- Phone: 1-866-444-3272; TTY: 1-877-889-5627

- Mailing address: U.S. Department of Labor Employee Benefits Security Administration, 200 Constitution Ave NW, Washington, DC 20210

- Local office: Use the EBSA website to find the location nearest you.

When is the earliest time a former spouse can start a pension benefit with a QDRO?

If the QDRO divides a defined contribution plan (e.g., 401k), in almost all cases, the former spouse should arrange to receive funds as soon as administratively possible. If the QDRO divides a defined benefit plan and the participant is NOT yet retired, the former spouse may choose to start the pension generally once the participant is at least 55.

In most cases, the former spouse may elect to receive benefits once the participant reaches the earliest retirement age (which is almost always age 55) through the date the participant starts the pension. If the QDRO divides a defined benefit plan and the participant is retired, the former spouse should contact the plan and arrange to receive funds as soon as administratively possible.

If the participant is not retired, will the plan contact the former spouse to tell them they are eligible to start the pension?

If the QDRO divides a defined benefit plan, which may pay early retirement benefits once the participant reaches a certain age (generally age 55), the plan will not notify the former spouse that they are eligible to start receiving benefits. Therefore, it is the former spouse's responsibility to learn when the plan will permit an early distribution. The former spouse will need to request an estimate of the monthly benefit and notify the plan when they want payments to begin.

Will a plan give the former spouse an estimate of the value of the participant's retirement benefit?

Generally, once the QDRO is sent to the plan, the plan will provide the former spouse an estimate of their share of the retirement benefit.

Once the QDRO is sent to the plan, what other responsibilities does a former spouse have?

It is always the former spouse's responsibility to notify the plan of any change of address. This way, they continue to receive updated information and materials concerning benefits.

Also, if the QDRO permits the former spouse to designate a beneficiary, they must contact the plan immediately once the QDRO is sent to the plan to complete the proper beneficiary designation forms.

What happens if a divorced participant does not update beneficiary forms?

After divorce, the participant of a retirement benefit should review their beneficiary designation and make any necessary changes by completing a new beneficiary designation form. A U.S. Supreme Court decision held that even if the divorce judgment revokes the beneficiary designation of the former spouse unless the participant changes that beneficiary form with the plan, the plan will be required to distribute benefits to the former spouse. (Kennedy v. Plan Adm'r for DuPont Sav. & Inv. Plan, 555 U.S. 285, 129 S. Ct. 865, 172 L. Ed. 2d 662 (2009).

Why is it so important to update beneficiary designations?

- Reflect current wishes

- Avoid legal disputes

- Prevent unintended consequences such as benefits going to an ex-spouse

- Compliance with legal requirements

Kennedy v. Plan Adm'r for DuPont Sav. & Inv. Plan

This case highlighted the legal implications of not updating beneficiary designations.

- Background: William Kennedy named his wife, Liv Kennedy, as the beneficiary of his DuPont Savings and Investment Plan. They divorced, and as part of the divorce decree, Liv waived her rights to William's retirement benefits. However, William did not update the beneficiary designation on his plan.

- Issue: After William's death, the plan administrator paid the benefits to Liv, the named beneficiary, despite the waiver in the divorce decree. William's estate sued, claiming that the benefits should go to the estate, as Liv had waived her rights.

- Supreme Court decision: The Court ruled in favor of the plan administrator because the plan documents governed the distribution of benefits. Since William had not updated the beneficiary designation, the plan correctly paid the benefits to Liv.

Legal implications

- This case established that plan administrators must follow the plan documents strictly when determining beneficiaries, regardless of external agreements or court orders.

- It highlights the importance of the account holder updating beneficiary designations promptly to reflect their current intentions.

- The ruling ensures plan administrators that they can rely on plan documents without needing to investigate further.

The goal of this blog is to break down the most important pieces to understand once a QDRO has been filed and sent to the plan. If you have additional questions about the process or want to speak with a QDRO Counsel expert, please don't hesitate to reach out via our website. (Mention Hello Divorce to get your free 15-minute call!)

Are you ready to file a QDRO? Secure your retirement post-divorce at a transparent, flat-rate fee. Click to learn more.

.png)

Filing a QDRO is just one task.

Make sure you've got everything covered with our FREE checklist.

Suggested: QDRO Glossary

The Center’s mission is to close the justice gap by providing access to high-quality QDRO products to nonprofit legal services organizations, self-help centers & qualified individuals in financial distress. The Center is supported by grants, nonprofit legal organizations and court-based self-help centers. Also as a way to give back to the community, QDROCounsel has provided the Center with financial support by donating an exclusive license to use QDROCounsel’s technology and by providing the resources to support that technology.